Warning: 87,000 new IRS agents are being hired and trained to crack down on taxpayers.

Protect yourself now!

IRS Audit & Collection Defense: Proactive Strategies for Family Protection

Dear Friend,

My name is Carlos Samaniego, and I’m a tax resolution specialist, and I am licensed by the Department of Treasury (IRS) as an Enrolled Agent.

This simply means that I help people solve their IRS tax problems. I am the person they call when the IRS comes knocking on their door.

I've been featured on Fox, CBS, ABC, PBS, and NBC. Here I am being interviewed on television discussing my book as the author of the book, "How to Make the IRS an Offer They Can't Refuse."

If you've ever been worried about being audited by IRS or being involved with IRS Collection, this will be the most important letter you'll ever read.

Why?

I will show you how to prevent a future IRS audit, possibly saving you tens of thousands of dollars in taxes, interest, and penalties.

The unusual aspect of what I do to help people resolve tax their IRS tax problems is that many of these problems are preventable through my automatic IRS Audit & Prevention & Collection Protection Service.

Once this system is set up for your family or business, it will automatically monitor everything the IRS does with your previously filed federal tax returns.

If the IRS flags one of your tax returns for further investigation, my

IRS Audit & Prevention & Collection Protection Service will immediately notify us.

his early notification will give us the opportunity to review and correct the specific tax return the IRS has flagged for further investigation.

By quickly fixing the issue that caused the IRS to flag your tax return, you may be able to prevent a stressful and expensive audit. I realize this may sound too good to be true. It certainly is true.

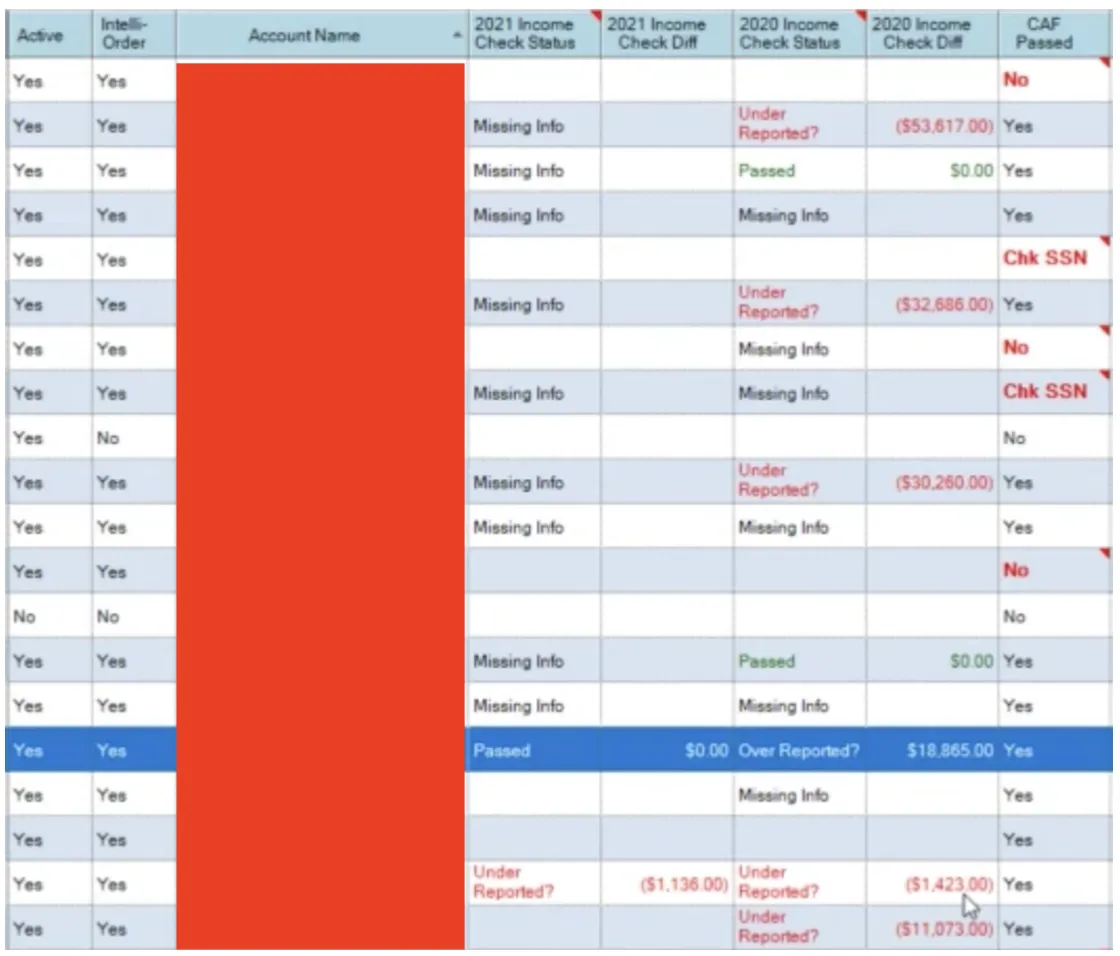

To see this powerful service in action, here’s a screenshot from inside my IRS Audit Prevention System:

This shows a summary of just 20 of my clients using my service. Of the 20 clients pictured, five have been flagged for possibly underreporting their income.

As you can see, five of the 20 clients (around 25%) have the potential to be audited in the near future.

Why is this possibility of being audited happening so frequently you might be wondering

This happens now more than any time in history because many of your year-end tax forms (W-2s, 1099, etc.) are now being emailed instead of mailed through snail mail. If one of these year-end tax form emails ends up in your spam folder, you’ll miss this income when filing your tax return.

Guess who won’t be missing this income?

The IRS!

The IRS receives every one of your year-end tax notices. Their system simply matches all of the income you reported in your tax return to all of the income reported through the year-end tax notices they received for your family. If you missed any of your income as reported in one of these year-end tax notices, you could be audited by the IRS.

Now, you may thinking this won’t be an issue for your previously filed tax returns, because you’ve included all of your income. This could be a very costly assumption to make because it is happening more each year.

In fact, my IRS Audit Protection Service recently flagged one of our clients for possibly underreporting their income. We asked this client to discuss this situation with the CPA who prepared the return in question.

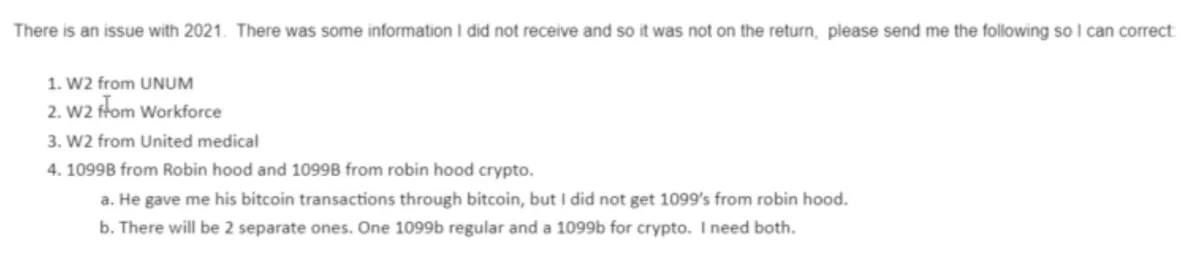

Here’s a screenshot of the email they received back from their CPA after reviewing their return:

It may be hard to read, but here’s what the CPA wrote:

“There is an issue with 2021. There was some information I did not receive so it was not on the return. Please send me the following so I can correct!”

This client missed four year-end tax statements, which led them to accidently under report their income.

Because my IRS Audit Prevention Service identified this issue before it moved forward to an audit, they have the ability to file an amended tax return correcting this mistake!

Now, I know what you may be thinking… why bother with this IRS Audit Prevention Service when you can just amend your tax return during your audit, right?

There are several important reasons why you should do EVERYTHING possible to prevent an IRS audit…

Audit Prevention Reason #1

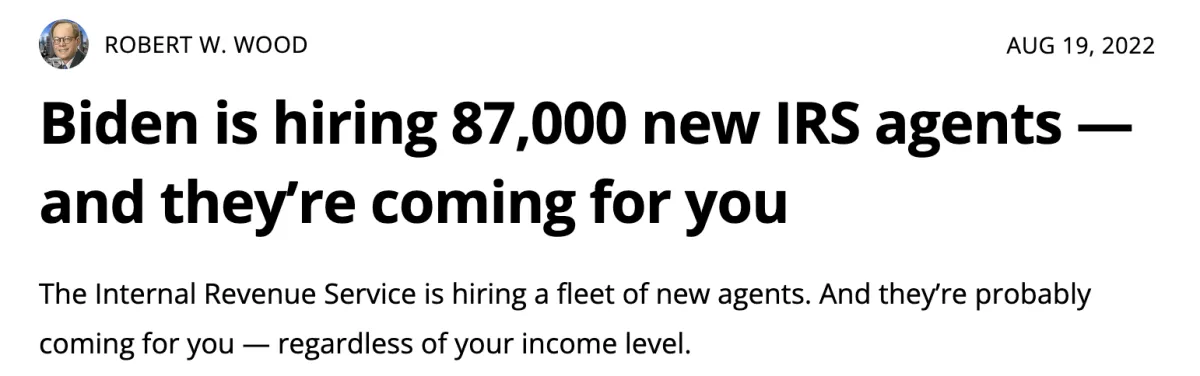

This news story from Cointelegraph.com reports,“The Inflation Reduction Act, signed into law in August, empowers the Internal Revenue Service with nearly $80 billion in new funds. The world’s most powerful tax collection agency is using the money to go on a hiring spree to fuel much tougher enforcement efforts.”

The main goal of every IRS employee is to ensure you file accurate tax returns. Who knows what the future holds with all the new IRS agents, but one thing is certain…

They Will Be Auditing Many More Tax Returns

My IRS Audit Prevention Service could be the ONE tool that prevents YOUR tax returns from being one selected for audit!

Audit Prevention Reason #2

Once the IRS identifies underreported income in one of your tax returns, they may elect to investigate several of your older tax returns looking for similar errors.

This means one small problem can quickly turn into several large problems. Each of these problems could cost you additional taxes, interest, and penalties. All of this can be avoided with my IRS Audit Prevention System!

Audit Prevention Reason #3

This reason is one I’m hesitant to share, because of how harmful it could possibly be to your family.

On a weekly basis I get calls from prospective clients when they find out that all of their money has been taken from their bank accounts. This usually happens at the worst possible moment, like when they're at a restaurant or the grocery store, and they pull out their debit card to pay, and it is declined, only to find out that the IRS has issued a bank levy for all their money. They are embarrassed, scared and terrified about what has just happened.

If you’re ever audited, and the IRS determines that you owe more money than you reported, took more expenses then you were allowed or even worse committed fraud, they will have the ability to…

FREEZE ALL OF YOUR BANK ACCOUNTS.

ISSUE A BANK LEVY TO WITHDRAW MONEY FROM YOUR BANK ACCOUNTS.

PUT A LIEN ON YOUR HOME AND OTHER ASSETS.

GARNISH YOUR INCOME (Paychecks & 1099 Income)

TAKE YOUR PASSPORT

SUSPEND YOUR DRIVER'S LICENSE AND YOUR PROFESSSOINAL LICENSES (Real Estate/Truckers/Medical)

And possibly, send you to prison if they find you've committed tax fraud!

This is actually how the legendary mobster, Al Capone, ended up behind bars. He went to prison for tax evasion, not for all the other crimes he committed.

Audits are VERY serious business.

They should NEVER be taken lightly.

I had a real estate broker come to my office earlier this year when the IRS flagged her business for audit; once they started the audit, they told her they were opening up the four previous years of audit for her business. She called it a “living nightmare!”

When I looked at her return the IRS wanted to initially audit. I knew exactly why she was being audited, and this could have been prevented if she had my IRS Audit Protection Service in place.

Things only got worse for this real estate broker because once the audit started, the IRS revenue agent decided to open 3 years of her personal tax returns for audit as well.

So, she ended up dealing with audit for three years of both her business and personal tax returns. We were able to help her with her audit, but more importantly she now has the audit prevention service protecting her business and personal returns. “

To understand how powerful my IRS Audit Prevention Service will be for your family, let’s highlight how the audit process works…

The IRS Computer System flags your tax return for internal review.

The IRS ques your tax return to be manually reviewed by IRS processing.

The IRS mails you a notice or flags your return for an IRS Revenue agent to make a visit to your home or office or will ask you to come into the local IRS Office.

My IRS Audit & Prevention & Collection Protection Service will notify us when one of your previously filed returns gets flagged for internal review. This is the first step in the audit process.

This is so important because it gives you time to review and correct the return (or returns) in question! When you file amended returns with all errors corrected, you eliminate the need for the IRS to audit your tax return and potentially save tens of thousands of dollars and penalties and interest

Now, let’s say you decide to skip my IRS Audit & Prevention & Collection Protection Service thinking you’ll just hire me down the road to help resolve a tax issue if one arises. This is certainly an option for you, as I will help you handle any IRS tax issue.

The problem is that my tax resolution fees typically range anywhere from $3,500 to $15,000+, depending on your specific tax problem. This fee is in addition to whatever taxes, interest, and penalties the IRS impose on your family or business.

All of this could be eliminated by through my IRS Audit & Prevention & Collection Protection Service.

In fact, here’s what some of my clients have said about my service:

“I have used Carlos IRS monitoring and Audit Service for over two years. Earlier this year, he noticed that the IRS had flagged that my 2020 had not reported over $32,781 of income. We discovered that my broker had reported my income to me personally, not my business. I had reported the income on my business. I was able to have my tax guy amend my tax return and avoid any audit or penalties.”

Jose A.

“Carlos is the light at the end of the tunnel. I have been going through a rough year, both personally and financially. I had no idea how to deal with my IRS tax issues, so I hired Carlos’s firm. Then I got an email from Carlos that my return was flagged by the IRS that I had not reported $441,080 in 2020. I was in shock! I immediately contacted my CPA and showed him my report. They were able to immediately start working on my tax return to prevent any audit or possible penalties and interest.”

Mathew Z.

“Carlos took control of everything and saved us hundreds of thousands of dollars. The IRS can take advantage of a lot of people. I’m just so glad we found him!!!!! Highly highly recommend it!!!

Lori F.

“I was in shock when Carlos looked at my IRS internal records and was notified that the best thing to do was do nothing at this time. I didn’t understand. He told me that my six-figure tax debt was going to expire in a few months. I didn’t know that IRS tax debt does expire. He told me he was going to monitor my account with his IRS and Audit monitoring system and make sure nothing happens to me and let me know the exact day that tax debt would expire. Then I got the call that my debt had expired!”

Ruben M.

Listen, you’ve worked hard to be able to earn the money to afford everything you have. Does it make any sense to assume the risk of a possible future IRS audit?

No, and that’s the power of my IRS Prevention Service.

Once you become a client of my service, we’ll immediately start monitoring everything the IRS does with any of your previously filed federal tax returns. In other words, you’ll protect your family from the possibility of a future audit!

1. Active monitoring and detection of IRS Audits & Exams months in advance. This will give time to make any necessary corrections, which will save you a great deal in interest and penalties.

2. Detection of liens and levies filed by the IRS on your account.

3. A search for First Time Abatement tax opportunities back to 2001 which may lead to additional refunds to offset any taxes owes.

4. An annual review of the current and prior three years of tax returns looking for refund opportunities. This is extremely important because if the IRS owes you money, they have no obligation to send you a refund unless you file for the money owed to you.

5. We will be notified of over 50+ possible alerts including, but not limited to IRS penalty abatement opportunities, Legal action filed, Notice of Intent to Levy, passport certification, examination request, lien filings, a tax return filed, all income documentation reported and much more.

6. An audit risk assessment analysis for your current tax return.

7. Annual income verification to be provided annually as requested to ensure you don’t accidentally underreport your income.

8. We’ll also start tracking your IRS payments and any estimated quarterly payments to help you minimize any tax penalties.

9. We will receive all IRS tax notices for your previously filed tax returns.

10. You’ll receive my book, “How to Make the IRS an Offer They Can’t Refuse.”

11. Access to our online membership portal and/or app, where you get our monthly tax tips newsletters that can save you thousands.

12. If you are married, we will automatically add your spouse. (Must be filing MFJ) to the service at no additional cost.

In addition, as a client of my IRS Audit Prevention Service, you will be eligible for discounted tax resolution services by my team for any future tax issue identified through our monitoring of your tax returns. Please note that if you file business tax returns including LLC, S-Corp or C-Corp, there would be additional fees to monitor the tax returns for these businesses.

I know you’re probably wondering what my IRS Audit Prevention Service will cost, right?

The monthly service fee for everything included in the service is $129.95. However, if you enroll today, we’ll lock in your monthly fee at just $99.95.

If you just decided to pay for the year its 50% Discount!

You are under no long-term obligation, as you can cancel with a simple email to my office with no questions asked cancellation policy.

After becoming a new client in my IRS Audit Prevention Service, you’ll need to provide us with an IRS form giving us the authorization to access your historical tax data. We’ll help you with this form.

At no time will any of your confidential information be shared with any third party.

As you might imagine, my IRS Audit & Prevention & Collection Protection Service is rather extensive for us to provide based upon everything included with the service. On any given day, my office receives dozens of IRS notices that must be personally reviewed and processed. Because of this large workload, we are unable to offer this service to an unlimited number of new clients.

The number of clients we’re able to accept into my IRS Audit & Prevention & Collection Protection Service in any given month is severely limited. And at certain times, we cannot accept any new clients, as the majority of our time is dedicated to assisting existing clients. Also, people referred to us by our existing clients take some of the new client openings we have available each month.

With this in mind, I can only encourage you to sign-up for the IRS Audit Protection Service now while it is available.

PLEASE UNDERSTAND THIS OPPORTUNITY TO HAVE MY AUDIT PROTECTION SERVICE IS ONLY AVAILABLE FOR A LIMITED TIME at the reduced price of just $99.95 per month or 50% at $600 for the year!

I look forward to protecting you from a future IRS audit!

J. Carlos Samaniego

Speaker, Author, Enrolled Agent, NTPI Fellow

© 2024 Tax Debt Consultants LLC. All Rights Reserved.